For homeowners, tracking your valuables is crucial—not just for day-to-day management, but in cases of theft, damage, or loss. A well-maintained home inventory is indispensable when filing insurance claims, streamlining the process and giving you a better chance at receiving proper reimbursement. Whether through a simple notebook, a digital folder, or an inventory app, this article will guide you through creating an effective home inventory.

What to Include in Your Home Inventory

Start by documenting high-value items with their make, model, and purchase details. Group everyday items into categories such as clothing, kitchen appliances, and furniture, providing general descriptions and approximate values to enhance organization. Keep pertinent records like receipts, warranties, and contracts that can verify the value of significant purchases. Regularly updating this list is crucial to maintain its accuracy and relevance.

Documenting Your Possessions

Taking photographs of rooms and individual high-value items is essential. Capture their condition, serial numbers, and any other identifying details. This visual record complements your written inventory, providing a clear reference for insurance purposes. Ensure that both digital and physical copies of your inventory are synchronized and updated regularly to capture any changes or new acquisitions.

Compiling and Storing Your Home Inventory Data

Inventory apps offer a convenient and efficient way to manage your inventory. They allow real-time updates and remote access, which can be crucial in times of emergency. Secure these digital records with strong passwords and, if possible, two-factor authentication. Additionally, store physical copies of your inventory in a secure location, such as a fireproof safe or a safety deposit box, to safeguard against digital failures.

Importance in Natural Disasters

In regions prone to natural disasters like hurricanes, a home inventory becomes even more vital. It can expedite the claims process after a disaster and possibly give you a faster recovery from losses. Documenting the state of your home and possessions before a hurricane can provide clear evidence for insurance claims, helping to clearly distinguish pre-existing conditions from storm damage.

Maintaining Your Home Inventory

Regular reviews and updates of your inventory can save time and enhance the accuracy of your records, making any insurance claims process smoother and more reliable. Aim to revise your inventory every few months, especially after making significant purchases. Utilize calendar reminders or set specific dates for inventory reviews to keep this task manageable.

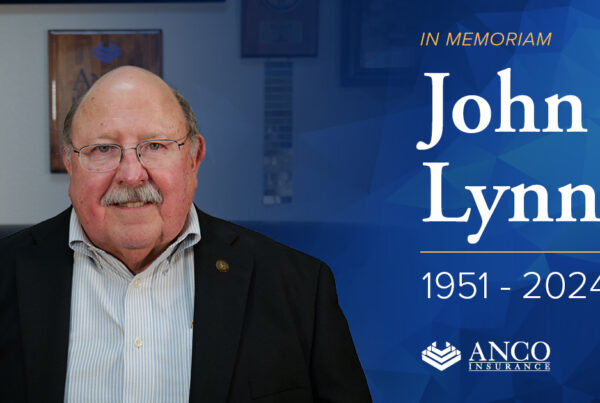

While setting up a home inventory might seem overwhelming, the benefits it brings are invaluable, especially when unexpected events occur. Start with your most valuable items and expand from there. If you ever need to file a claim or have questions about the claims process, our claims team at ANCO Insurance is ready to assist, aiming for a smooth and efficient experience.